A baby’s first cry is critical for survival. Every minute about 15 babies are dying in India due to asphyxiation as they are failing to take the first gasp, in maternity homes which can’t afford costly imported infant warmers priced at Rs 8 lakh a piece. Many midwives in India thus keep new born babies under table lamps to provide the critical heat, needed for the first breath.

As a student of IIT Chennai in 1988, Sashi Kumar, was given a task to repair UK made baby warmers for a Chennai Trust hospital. Scores of new borns were dying, as the UK company had no service support in India. Kumar, not only fixed the warmers, but started making his own. He supplied the first set to the Chennai hospital. That’s how Phoenix Medical Systems was born.

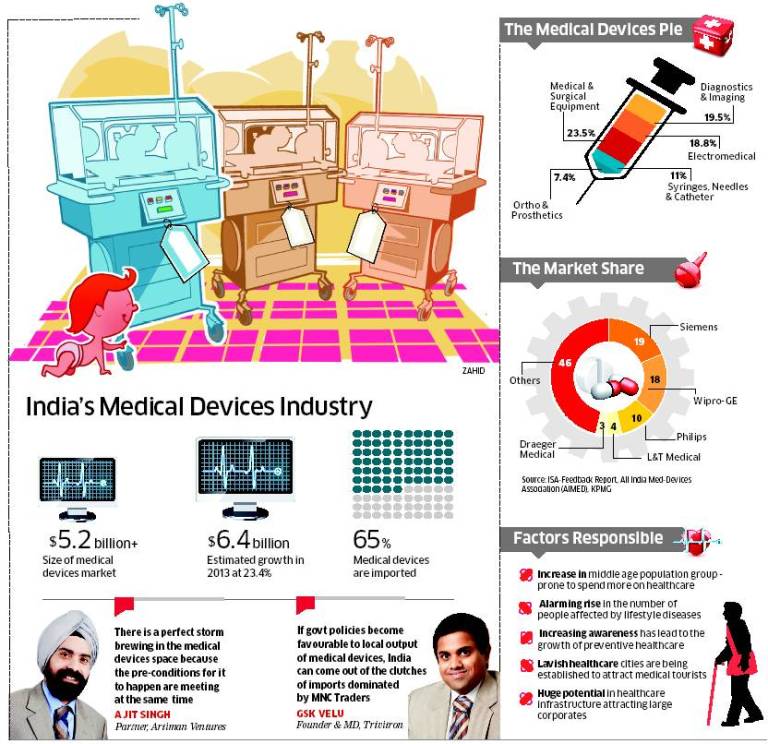

Phoenix shares its birth with about 700 medical equipment companies in India’s $5.2 billion ( Rs 28,000 crore) medical device industry, who have emerged as affordable alternatives to equipments suppplied by global giants such as GE, Siemens or Philips. Kumar’s baby warmer costs about Rs 80,000 a piece, ten times less than an imported warmer.

“There is a perfect storm brewing in the medical devices space because the preconditions for it to happen are meeting at the same time,” says Ajit Singh, partner at Artiman Ventures–which manages a global corpus of about Rs 4,100 crore.

“The factors that are driving Indian innovation in medical devices are availability of talent, global demand, current deficit and the disruptive impact by reduction in cost,” says Singh who worked as CEO of the digital radiology and medical Informatics business of Siemens Healthcare, based in Germany.

India’s $63 billion healthcare market has spawned a medical devices industry, of which now almost 65% is made is imported, often too expensive to be used by small nursing homes and hospitals.

The sons of the soil are standing up to make their own catheters, X-Ray machines, imaging equipment, ECG scanners and even robots to cure cancer, blindness and heart diseases. Medical device industry in India is set to grow 23% to $6 billion by this year end, according to KPMG.

Kumar of Phoenix explains the reason behind the high growth with example of a simple product. “Due to lack of affordable maternity beds, often women die in India of excessive bleeding as their cervix is cut by novice midwives to make a baby come out.” Kumar, 49, supplies mechanised maternity tables costing 80% cheaper than imported ones to hospitals such as Narayana Hrudalaya, Apollo Group, AIIMS and Escorts. The Chennai firm is expected to clock revenues of Rs 50 crore this year.

Cost is not the only driver. Gaps realised by some Indians who worked for large firms like GE and Philips, has resulted in breakthrough innovations.

Treating cancer by robots is an example. One of 10 Indian citizen dies of cancer, often due to repetitive chemotherapy costs, which run from Rs2-Rs 5 lakh.

To solve this, Chennai-based Perfint Heathcare has developed next-generation robots that treat cancer by precisely inserting a needle in the affected area to burn or freeze a patient’s tumour, thus unaffecting the good tissue.

The founders of the firm all former GE Healthcare honchos quit jobs in the private sector, to fill this highly visible gap.

The robots are used by radiologists for biopsy, drug delivery and ablation, a process in which the tumour is burnt or frozen by inserting a needle in the affected area.

“Instead of building a low cost car, we created another way of transportation,” says S Nandakumar, 43, co-founder and CEO of Perfint.

Besides being accurate, the swift movement of the robot causes less pain and discomfort to the patient.

The firm, sells these products for $150,000-$300,000 to markets like South-East Asia, Europe and Latin America. It is clocking revenues of about Rs 50 crore and aims to achieve revenues of Rs 550 crore in the next four years.

Perfint has raised a total funding of $28 million till now from Norwest Venture Partners (NVP), IDG Ventures and Accel Partners.

Blindness is another problem which has resulted in innovation. Of the 39 million people with blindness in the world, majority (12 million) are in India and 80% are suffering from curable blindness.The ophthalmologist to patient ratio is approximately 1:60,000 in the country.

Founded by former Philips executives, Bangalore based Forus Health has developed ‘3nethra’, a low-cost portable pre-screening ophthalmology device. “You can carry the device in a suitcase. It is rugged and has been carried on bus tops and even on horses in places like Mizoram,” says K Chandrasekhar, 45, co-founder and CEO, Forus.

The device which is one-sixth the cost of other comparable devices can identify multiple diseases such as cataract, glaucoma, diabetic retina and refraction, which cause blindness.

Forus, has already done over 100 installations at various institutions and is now selling these devices in emerging markets like Africa, Thailand and Muscat.It now also plans to enter Latin America and the US.

Last year in April, Accel Partners and IDG Ventures, together invest $5 million in Forus Health.

Almost a decade ago many IITs and engineering colleges started biomedical programmes, which have started to turn out skilled talent. “We are now seeing first signs of fruition,” says Singh who also is a consulting professor at the School of Medicine at Stanford University.

Entrepreneurs who had ventured in the 1990s in distribution of medical equipment distribution are now turning up to manufacture their own.

BITS Pilani graduate GSK Velu, 46, founded the Trivitron Healthcare in 1997 after a stint at Chiron Diagnostics as country head. After almost 10 years of distribution, Velu turned to manufacturing his own equipment. Trivitron has grown to become one of the largest Medical Technology company in India.

The company which has established several manufacturing facilities in the country and exports products to to 165 countries aims to clock revenues of Rs 700 crore in FY12-13.

Even though the fees for healthcare services was brought down to a minimum level, the missing link was the pricing of the medical devices, for which India was still dependent on the West.

It was a dream to world class medical devices at a fraction of cost, that led Vishwaprasad Alva, 45, quit a lucrative job at GE in Milwaukee to return to India. He started Skanray Technologies in 2007 in Mysore “We have been able to make world class medical equipment almost 50% cheaper than those produced by the large firms,” says Alva

Alva makes dental imaging systems, mobile X-ray units, USB based ECG units, mobile X Ray units, and other remote health monitoring systems. He also exports to Europe and US often at less than half the price of other similar global products in the market.

“Earlier, it would cost a villager Rs 2000 per trip to a city to get a disease diagnosed in a hospital. We are able to do it in one tenth of the cost with our low cost portable devices,” he adds.

The firm which bought L&T medical equipment business last year is expecting to gross Rs 500 crore turnover in next five years.

Investor support

Last year in October, Fidelity Growth Partners India invested Rs 400 crore in Trivitron.Private equity firm CX Partners invested Rs 200 crore in Sutures India which makes surgical sutures.

“This year may well be a defining period for attracting private equity or strategic transaction interest,” says Mahadevan Narayanamoni, partner and national leader for healthcare and life-sciences advisory at Grant Thornton – India

Investors say sector in India may follow the growth curve in other developed markets where large, indigenous makers of medical equipment have emerged over last 10 years.

Singh of Artiman, believes medical devices sector may follow in software’s footsteps. “When software industry emerged in India, it became a trend, it was not a one time effect. India became the global supplier of software.”

The $63 billion Indian healthcare Industry is expected to a contribute about 8% to India’s GDP this year, a rise from 5.6% last year, which is attracting investors towards the overall market.

According to estimates, India will need an investment of about $400 billion by 2026 in healthcare. The bed to population (1000 persons) ratio in India stands at only 1.5 compared to a global average of 3.3, indicating a huge potential for growth.

Challenges before Entrepreneurs

Despite the opportunity, entrepreneurs complain that there is no incentive by the government to

locally manufacture unlike help given in China or Brazil.Imports from China have started dominating the imported market which constitutes 65% of devices.

“If India’s policies become more favorable to local production and innovation, we can come out of the clutches of imports and become self sufficient in the sector,” Velu of Trivitron adds.

Last year in the Union Budget, customs duty was reduced from 16% to 8% for medical equipments, which made domestic makers even more unhappy.

Not enough clinical trials happening from India and quality issues also pose as challenges. Technology is a great barrier still for entry. Many entrepreneurs have not been able to overcome the foreign regulatory environment.

“Technically and morally the products are reliable. However the challenge is that they now need to overcome the US and European regulatory threshold,” says Singh of Artiman.

©TIL